Federal Reserve Set to Begin Cutting Interest Rates in September

Monthly Market Summary

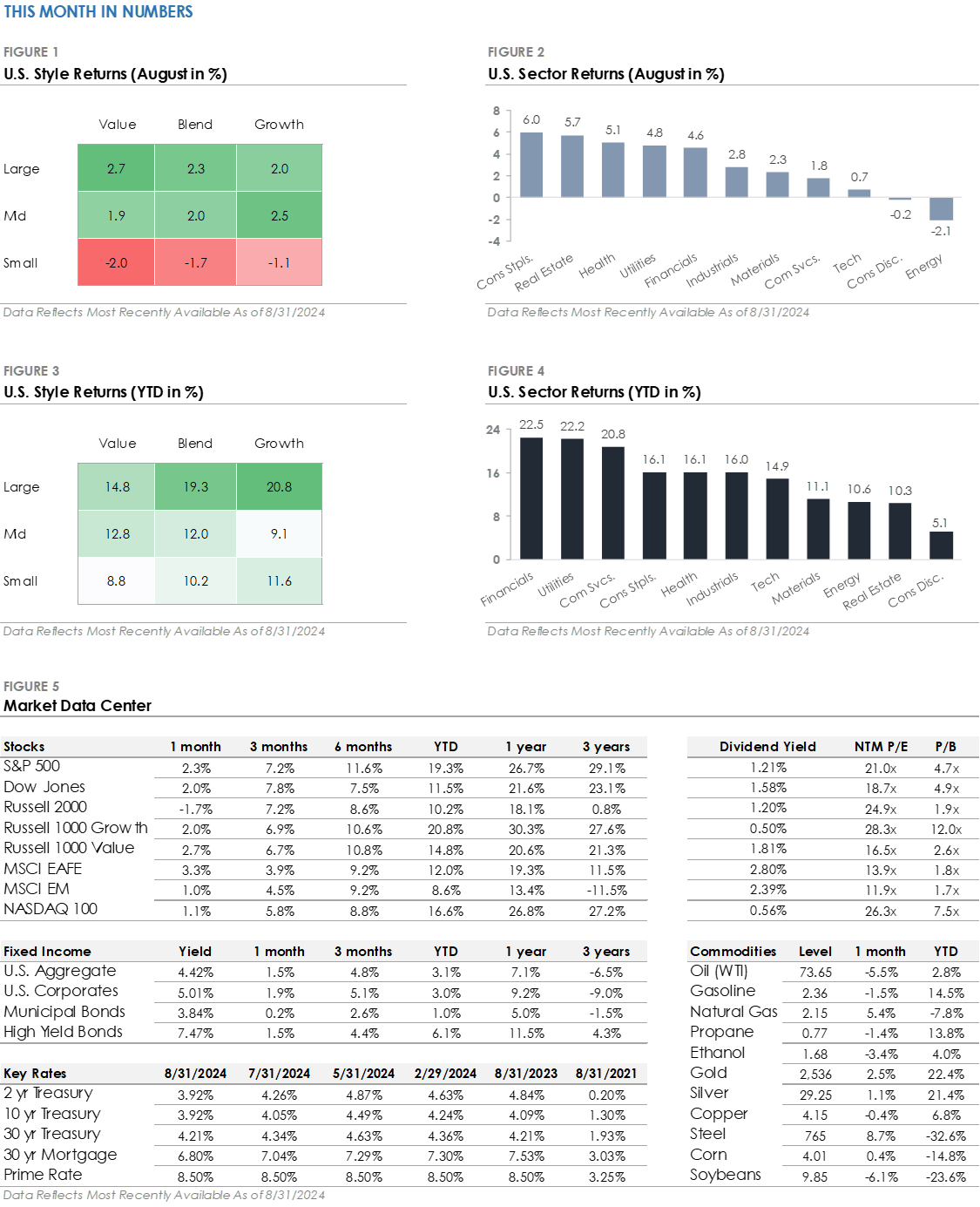

- The S&P 500 Index returned +2.3% in August, outperforming the Russell 2000 Index’s -1.7% return. Nine of the eleven S&P 500 sectors traded higher, led by Consumer Staples, Real Estate, Health Care, and Utilities.

- Corporate investment-grade bonds produced a +1.9% total return as Treasury yields declined, slightly outperforming corporate high-yield’s +1.5% total return.

- International stock performance was mixed. The MSCI EAFE developed market stock index returned +3.3% and outperformed the S&P 500, while the MSCI Emerging Market Index returned +1.0%.

Stocks Rebound Following an Early-Month Selloff

Stocks traded higher in August despite an early-month selloff. The S&P 500 dropped over -5% in the first week after a report showed unemployment rose to 4.3% in July. Small-cap stocks underperformed as investors pulled back from riskier assets amid volatility. However, financial markets quickly stabilized and climbed throughout the month. The S&P 500 recovered all its losses, ending the month less than -1% below its all-time high from mid-July. The Nasdaq 100 Index, which includes the artificial intelligence companies that drove the stock market higher in early 2024, lagged the broader market. In the bond market, Treasury yields fell for the second consecutive month, driven by expectations for deeper rate cuts in response to rising unemployment. Bonds traded higher for a fourth consecutive month as Treasury yields declined and investors rushed to lock in current fixed income yields ahead of the first interest rate cut.

Fed Set to Cut Interest Rates as Focus Shifts to the Labor Market

Investors expect the Federal Reserve to start cutting interest rates at its next meeting on September 17th. Fed Chair Jerome Powell signaled the move at last month’s Jackson Hole conference by saying, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.” It was the Fed’s clearest policy signal since it last raised interest rates 14 months ago.

The Fed’s transition to cutting interest rates comes as its focus shifts from lowering inflation to supporting the labor market. Since the last rate hike in July 2023, inflation has dropped from 3.3% to 2.9%, while unemployment has risen from 3.5% to 4.3%. The Fed is more confident that inflation will return to its 2% target but is concerned about the overall health of the U.S. labor market. The key question is how much and how quickly the Fed will lower interest rates. Investors anticipate that the Fed will cut rates by approximately -2% through the end of 2025, but the timing and amount will depend on the economy’s path. A weaker economy would justify more rate cuts, while a stronger economy would likely lead to fewer rate cuts.